Ever feel like you’re doing a lot of work to promote your bank or credit union but aren’t seeing consistent results? Maybe you’re running promotions to drive deposits and loans but as soon as those campaigns turn off, so do the applications. Perhaps you’re investing heavily in sponsorships, events and large cable buys but don’t see customers or members lining up to open accounts.

If this is the case, you may be mismatching your brand investments.

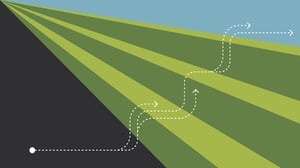

Marketing, and the tactics used to do it, can differ greatly depending on the brand and its goals. But one thing all marketing has in common, at its core, is that it's an investment you make to grow your brand, its products and its services. And, like any investment strategy, it’s maximized through diversification. The following combination are the three essential tiers that successful brands need to maintain and grow.

Tier 1: Emotional Branding

Emotional branding aims to create an emotional connection between a brand and its customers. As much as audiences can be rational, we also know that customers make buying decisions based on emotion and emotional appeal as well. By creating an emotional connection, brands can build stronger customer loyalty and increase lifetime value.

One of the most important aspects of emotional branding is storytelling. By telling a compelling story, brands can create a connection with audiences that goes beyond products and services. The key is to know who your audience is, and develop a narrative that aligns with your brand while resonating you’re your audiences to help them view your brand in a new and meaningful way.

Brands that have a clear and consistent personality (often backed with a brand archetype) are able to create a stronger emotional connection with customers. They can leverage their personality by being consistent in the communication of their traits and characteristics that make them unique and distinctive in their identity.

Emotional branding is typically what we recognize as “branding”, although it’s often a skipped step as banks and credit unions rush to market their differentiation.

Tier 2: Differentiation Branding

Brand differentiation showcases a unique and compelling position for a brand in the minds of consumers. It involves identifying and communicating the unique attributes, values, and benefits that set a brand apart from its competitors and make it unique to specific audiences or markets.

Differentiation is often achieved through a variety of propositions, such as:

- Unique features and benefits: Offering unique and desirable features or benefits that are not available from competitors can help a brand stand out. This could include things like superior quality, innovative features, or sustainable materials. A common stumbling block here is promoting table stakes (things consumers already expect), such as “fast approvals” or leaning into general, unmeasurable statements such as “friendly staff” or “we care” statements.

- Brand personality: Continuing to leverage your unique brand personality will help differentiate. This is often seen as being consistent and distinct in tone of voice, visual style, or brand values. It’s important to note that this is not the same as emotional branding because it doesn’t retain the storytelling which is critical to emotional branding.

- Target market: Focusing on a specific target market that is underserved or overlooked by competitors can help differentiate a brand. For example, a brand that specifically targets environmentally conscious consumers or offers products for a specific age group could stand out from competitors that offer more general products.

- Customer experience: Providing a unique and memorable customer experience can differentiate a brand from competitors. However, in contrast to the volume of competition, the customer experience must be truly unique and not just faster/better service or knowledgeable/friendlier staff. This should be seen as something completely unique to your bank or credit union such as receiving a free succulent plant with any new account opening or loan. Just make sure you find something that aligns with your brand archetype.

Effective brand differentiation requires a deep understanding of the target market and the competitive landscape. Brands need to conduct thorough market research to identify the needs, preferences, and behaviors of their target audience, as well as the strengths and weaknesses of their competitors.

Tier 3: Call to Action Branding

Commonly referred to as conversion marketing, call to action efforts are focused on turning website visitors or social media followers into customers. The goal of conversion marketing is to encourage website visitors to take specific action, such as making a purchase, signing up for a newsletter, or filling out a form. Conversion marketing is an important part of any marketing strategy and a core element of brand marketing.

However, this is where a lot of banks and credit unions begin to sound and feel very same-sy, by limiting promotions to rate chasing or generic special offers as their way to attract new members and customers. While rates and offers play a role in the decision-making process for audiences, it certainly isn’t the be all end all for consumers.

It is critical to have a strategy in place that layers all three facets of your brand marketing via emotional, differentiation, and call to action for your potential customer/member. Having a diversed marketing investment in a layered strategy will build long term followers, brand recognition and mindshare with the emotional and differentiation branding. Call to action branding will ensure you capture users who are ready to act and won’t feel the need to shop around or rate hunt because they know who you are and are already aligned with you.

COMMENTS